Some options

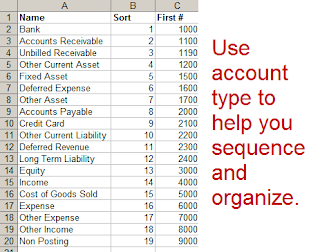

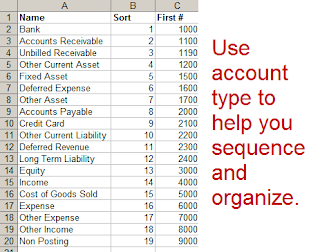

1000s: Numbers in the 1000s are assets 2000s: Liabilities 3000s: Equity 4000s: Income 5000s: Cost of Sales 6000s, 7000s: Other operating expenses 8000s: Other income 9000s: Other expenses

4. Chart of Accounts Best Practices:

From Accounting Tools

--

1000 Asset Accounts

2000 liability accounts

4000 sales accounts

Department Categories

Each department contained within the transaction category is assigned a number. For example, each asset starts with number one. The petty cash account could be numbered 1000, the checking account numbered 1020 and the savings account numbered 1030. Under liabilities, the accounts payable could be numbered 2000, accrued expenses 2100, and wages payable 2200. Make your general ledger numbering system large enough that you can add new accounts as you need them.

Individual Accounts

Every individual account within each department category is assigned a number. For example, your accounts payable general ledger account number is 2050. You can assign creditor ABC Corporation number 2051, creditor DEF Corporation number 2052 and creditor XYZ Corporation number 2053. When you pay creditor ABC Corporation's invoice, you credit account number 2051 with the payment.

Sales Accounts

Your general ledger numbering system can keep track of your business income. Each source of income can be assigned a number to help with this. For example, your sales transaction category number is 4000. By assigning account number 4100 to product one, account number 4200 to product two and account number 4300 to product three, you can see how much income each product generates.

2. The 3 digit code: From Accounting Tools

Assets - Account codes 100-199

Liabilities - 200-299

Equity accounts - 300-399

Revenues - 400-499

Expenses - 500-599

We can have 3 sets of number account numbering (the 7 numbers account

numbering

SBUcode + Department Code + Account Number

xx xx xxx

1. We can set up SBU account:

01 La Union

02 Pangasinan

03 Calamba

04 Calapan

05 Oton

06 BPI

07 Majorem Lending

08 Destiny

09 CMCS

10 Cremation

b. Department code:

01. Accounting

02. Operations

03. Marketing

Example: 01 03 500

So this is La Union expense account

3. The quickbooks account numbering system:

QuickBooks assigns numbers to each existing account, based on a standard system of numbering as follows:

Chart of Accounts Best Practices

The following points can improve the chart of accounts concept for a company:

- Consistency. It is of some importance to initially create a chart of accounts that is unlikely to change for several years, so that you can compare the results in the same account over a multi-year period. If you start with a small number of accounts and then gradually expand the number of accounts over time, it becomes increasingly difficult to obtain comparable financial information for more than the past year.

- Lock down. Do not allow subsidiaries to change the standard chart of accounts without a very good reason, since having many versions in use makes it more difficult to consolidate the results of the business.

- Size reduction. Periodically review the account list to see if any accounts contain relatively immaterial amounts. If so, and if this information is not needed for special reports, shut down these accounts and roll the stored information into a larger account. Doing this periodically keeps the number of accounts down to a manageable level.

If you acquire another company, a key task is shifting the acquiree's chart of accounts into the parent company's chart of accounts, so that you can present consolidated financial results. This process is known as mapping the acquiree's information into the parent's chart of accounts.

Accounts:

Assets:

- Cash (main checking account)

- Cash (payroll account)

- Petty Cash

- Marketable Securities

- Accounts Receivable

- Allowance for Doubtful Accounts (contra account)

- Prepaid Expenses

- Inventory

- Fixed Assets

- Accumulated Depreciation (contra account)

- Other Assets

Liabilities:

- Accounts Payable

- Accrued Liabilities

- Taxes Payable

- Wages Payable

- Notes Payable

Stockholders' Equity:

- Common Stock

- Preferred Stock

- Retained Earnings

Revenue:

- Revenue

- Sales returns and allowances (contra account)

Expenses:

- Cost of Goods Sold

- Advertising Expense

- Bank Fees

- Depreciation Expense

- Payroll Tax Expense

- Rent Expense

- Supplies Expense

- Utilities Expense

- Wages Expense

- Other Expenses

5. The Chart of Accounts with the number:

| Account Number | Description |

| 010 | Cash |

| 020 | Petty cash |

| 030 | Accounts receivable |

| 040 | Reserve for bad debts |

| 050 | Marketable securities |

| 060 | Raw materials inventory |

| 070 | Work-in-process inventory |

| 080 | Finished goods inventory |

| 090 | Reserve for obsolete inventory |

| 100 | Fixed assets – Computer equipment |

| 110 | Fixed assets – Computer software |

| 120 | Fixed assets – Furniture and fixtures |

| 130 | Fixed assets – Leasehold improvements |

| 140 | Fixed assets – Machinery |

| 150 | Accumulated depreciation – computer equipment |

| 160 | Accumulated depreciation – Computer software |

| 170 | Accumulated depreciation – Furniture and fixtures |

| 180 | Accumulated depreciation – Leasehold improvements |

| 190 | Accumulated depreciation – Machinery |

| 200 | Other assets |

| 300 | Accounts payable |

| 310 | Accrued payroll liability |

| 320 | Accrued vacation liability |

| 330 | Accrued expenses liability – other |

| 340 | Unremitted sales taxes |

| 350 | Unremitted pension payments |

| 360 | Short-term notes payable |

| 370 | Other short-term liabilities |

| 400 | Long-term notes payable |

| 500 | Capital stock |

| 510 | Retained earnings |

| 600 | Revenue |

| 700 | Cost of goods sold – materials |

| 710 | Cost of goods sold – direct labor |

| 720 | Cost of goods sold – manufacturing supplies |

| 730 | Cost of goods sold – applied overhead |

| 800 | Bank charges |

| 805 | Benefits |

| 810 | Depreciation |

| 815 | Insurance |

| 825 | Office supplies |

| 830 | Salaries and wages |

| 835 | Telephones |

| 840 | Training |

| 845 | Travel and entertainment |

| 850 | Utilities |

| 855 | Other expenses |

| 860 | Interest expense |

| 900 | Extraordinary items |

Other Samples (using 4 digits)

PAGSASANAY SA TAGUMPAY (Training for Success)

SETTING THE STANDARDS IN INTERMENT SERVICE

Innovation creates more wealth and more customers

Jorge U. Saguinsin

Be a BIDDA now

RRURAC (Read, Reflect, Understand, Realize Act, Check)

Please visit the following sites:

Notice: This email address is a private property of Holy Gardens Group and its contents are private and confidential. Its contents and attachment may not be copied nor forwarded to parties other than the ones intended to, nor can the contents be used other than the original intent You are advised to delete the message you received if in case it may have been wrongly sent to your good office

No comments:

Post a Comment

1. One of our beliefs is learning. It pays that you learn more to do more Just to survive you have to learn how forage in a forest or raise your food, catch prey

2. In order to discharge your job well, you have to learn your admin plan the process flow and standards.

3. To keep up with changes, you have to learn and read. There is no other way

4. signify that you have read by putting your name on this comment box. Every staff must: post the name on this comment box, or like, agree/will do. Your registering on this comment box is being graded under communication. Observe RRURAC: Read, Reflect, Understand, Realize (apply to reality) Apply, and Check (if it works)

You need to make __comments a month to qualify for promotion under our CCD

Read the posts on this site every AM talk. Many problems arise simply because people do not know what to do, because they did not read this site

We are making sure that you improve yourself, engage yourself in self improvement through this site...

Note: Only a member of this blog may post a comment.