Rizal Philippines

December 8, 2017

RA 7641

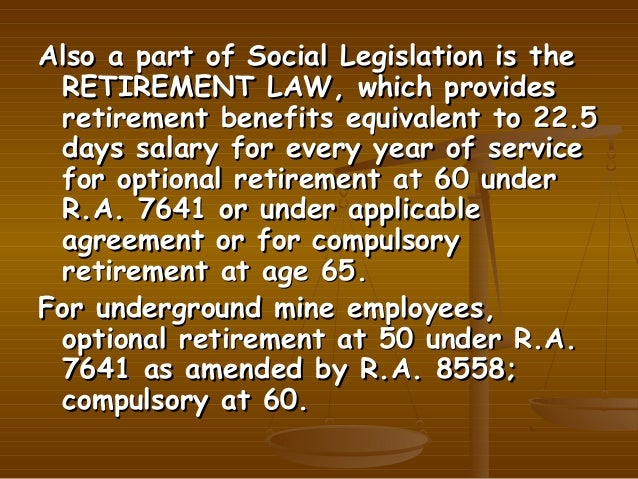

"In the absence of a retirement plan or agreement providing for retirement benefits of employees in the establishment, an employee upon reaching the age of sixty (60) years or more, but not beyond sixty-five (65) years which is hereby declared the compulsory retirement age, who has served at least five (5) years in the said establishment, may retire and shall be entitled to retirement pay equivalent to at least one-half (1/2) month salary for every year of service, a fraction of at least six (6) months being considered as one whole year.

"Unless the parties provide for broader inclusions, the term one-half (1/2) month salary shall mean fifteen (15) days plus one-twelfth (1/12) of the 13th month pay and the cash equivalent of not more than five (5) days of service incentive leaves.

"Retail, service and agricultural establishments or operations employing not more than (10) employees or workers are exempted from the coverage of this provision.

The Philippine law provides for a retirement pay of 1/2 month salary for every year of continuous service to every employee who retires on his 60th year birthday but not beyond 65. This is based on his last pay (basic) + 1/12 of his 13th month pay before retirement. The company has to start contributing on the 61st month.

Based on the BIR ruling, the deduction will be allowed tax exempt, provided the amount shall be amortized for a period of 5 years. The benefits that will be derived from this by the employee, including the contributions thereof shall be tax exempt, free. The retirement fund shall be free from interference of business management and if possible handled by an employee council with a comptroller from the company

Should the employee leave before the 20th year or 60th year, whichever comes first, the employee gets nothing. It is either that the contribution be returned to the employer, or forms income of the fund.

At Unisun before we opted for a provident, contributory fund, so that the employees get something when he resigns, ie his contribution.

The contribution computation to arrive at 22.5 days for every year for every year of service is:

22.5/26 = 86 of monthly pay say P10,000 --> P8,600/10000 = 8.6/year /12 = 7.16%

So we had 5% employers contribution and 1% employees

E.g Salary of P10,000

EE 7.5% = 750.00

Ee 1.0 = 100.00

Total = 850.00 x 12 = 10,200

Benefits from the provident fund:

1. Salary loan of one month, for those who have made 18 month contribution with co maker

2. Health examination once a year;

3. Bereavement aid of up to P3,000.00 for immediate family members

4. Scholarship for poor but deserving children of GT, TS

Investments:

Funds of the fund may be invested in the following manner:

20% cash or CIB

40% loans to members

20% marketable securities of 4% gross or more

10% memorial park plots

10% corporate investments

We must start implementing this now.

We will compute since we started the operations of this group, ie, year. 2,000

No comments:

Post a Comment

1. One of our beliefs is learning. It pays that you learn more to do more Just to survive you have to learn how forage in a forest or raise your food, catch prey

2. In order to discharge your job well, you have to learn your admin plan the process flow and standards.

3. To keep up with changes, you have to learn and read. There is no other way

4. signify that you have read by putting your name on this comment box. Every staff must: post the name on this comment box, or like, agree/will do. Your registering on this comment box is being graded under communication. Observe RRURAC: Read, Reflect, Understand, Realize (apply to reality) Apply, and Check (if it works)

You need to make __comments a month to qualify for promotion under our CCD

Read the posts on this site every AM talk. Many problems arise simply because people do not know what to do, because they did not read this site

We are making sure that you improve yourself, engage yourself in self improvement through this site...

Note: Only a member of this blog may post a comment.